Prof. Dr. Jan Viebig Global Co-CIO ODDO BHF AM.

“Our focus is on companies expected to directly benefit from AI‘s increasing ubiquity, either because they possess extensive data, efficient AI algorithms, or because they produce the hardware for optimising neural networks.”

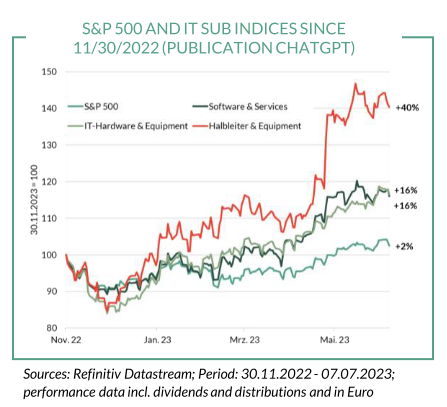

The launch of ChatGPT, a chatbot which interacts with users in a conversational way (text messages), has garnered considerable public and investor interest. While this application by OpenAI is currently making waves – it’s been reported that the number of users had already surpassed the billion mark by April 2023 – it’s far from being the only player in the field. Numerous applications in the sphere of ‘generative artificial intelligence’ have recently achieved astonishing levels of performance. This trend is mirrored in the stock market’s trajectory over the past few months. Figure 1 shows that all three sub-indices of the S&P 500’s technology sector have significantly outperformed the overall index since November 2022, when ChatGPTwas introduced.

Let’s first clarify some terminology fundamental to our understanding. ‘Artificial intelligence’ (AI) is a blanket term for all technologies aimed at automating human activities. Historically, the first approach pursued, now referred to as ‘symbolic intelligence’, has led to the development of ‘expert systems’ in the 1980s. The basic idea was for a computer to autonomously derive results from data and rules. In recent years, a breakthrough has been achieved in a subfield of artificial intelligence known as ‘machine learning (ML)’. Here, computers utilise neural networks and continuously improved machine learning techniques to learn rules from a diverse set of data. This signifies a fundamental breakthrough, as computers are now able to learn from data without the need for explicit programming. In other words, machines can now learn from data in much the same way as humans learn from experience.

Researchers have made the most significant advances in methods within the sphere of ‘supervised machine learning’ or ‘supervised ML’. In this approach, the computer is provided with data, such as texts or images, alongside the desired outcomes. It is then up to the computer to formulate ‘rules’ based on this information. The computer executes data transformations according to specific methods, leading to new ‘representations’ of the data. Such transformations are carried out until the representation optimally aligns with the desired outcomes. ‘Deep learning’ is a concept whereby data transformations are performed and optimised across numerous layers.

Groundbreaking developments in the field of ‘deep learning’ encompass ‘convolutional neural networks’ and transformer models. The former specialises in image recognition and processing, but is also suitable for other purposes, such as speech and audio signal processing.

Key applications include facial recognition and medical image analysis. However, there are now also systems that generate images based on given specifications. The strength of transformer methods lies in processing natural language, translating speech and text, and generating text including the development of programming code more efficiently than previous algorithms. Current examples of transformer models include ChatGPT and Google’s BARD.

How can investors capitalise on advances in artificial intelligence development? In the front line, opportunities lie within those companies directly contributing to the advancement and growing ubiquity of artificial intelligence.

Firstly, AI couldn’t function without a robust database. Data is crucial for machines to learn, making companies possessing vast datasets particularly appealing. Moreover, AI applications are highly compute-intensive, demanding hardware capable of optimising billions of parameters based on a virtually endless stream of data. Consequently, processing power, storage capacity, and high-speed connections are of paramount importance. Additionally, the actual AI – the algorithm or model that trains and learns with data – is of course essential. According to IT market research and consultancy firm IDC, the market for AI software will grow from $340 billion in 2021 to $790 billion in 2026, equating to an annual growth rate of 18%. Lastly, IT service providers are also likely to gain from the rise of AI, as more and more companies begin to develop application capabilities.

In addition to the tech companies directly involved, numerous others are likely to benefit from AI. The use of AI is projected to significantly bolster productivity over the next decade, and will no doubt shape the future of both the economy and society as a whole. This, in our opinion, is what establishes AI as a ‘megatrend’.

The economic opportunities and risks for indirectly impacted companies are difficult to assess at this stage. They could emerge as winners, but equally as losers, from technological advancement. In terms of investment strategy, our focus is on companies expected to directly benefit from AI‘s increasing ubiquity, either because they possess extensive data, efficient AI algorithms, or because they produce the hardware (particularly semiconductors) for optimising neural networks. We continue to shun speculative stocks whose valuation rests solely on lofty expectations. This is in line with our approach centered on quality and long-term investment success. In this respect, we feel well positioned with companies such as ASML, TSMC, Samsung, Microsoft, Alphabet, and Synopsys, to name a few.