Investors can identify emerging market opportunities by focusing on countries’ prospects for human capital growth.

Robert Simpson, Head of Emerging Markets Investment Strategy & Solutions (Fixed Income & Sabrina Jacobs, Senior Client Portfolio Manager, Pictet Asset Management.

Investors spend vast efforts focusing on capital – capital accumulation, replacement capital, cost of capital, natural capital and so on. But another significant driver of an economy’s long term performance, and, by extension, investment performance, is human capital1, be that life expectancy, education, equality or softer indicators about quality of life.

It’s our belief, based on a wealth of research, that investors can generate excess returns by correctly identifying where there is greatest scope for human capital to grow. That is particularly the case for investors in emerging market bonds.

But that’s not a call for unrestricted development. Accumulation of human capital needs to happen within the framework of what is environmentally sustainable – after all, unsustainable development is in the end, self-defeating, by hurting the prospects of future generations.

The human factor

Human capital can, by itself, be a significant engine of economic growth. Take the example of Singapore, Taiwan and South Korea, which aren’t particularly blessed with natural resources, but over the past half century have all vaulted into the top echelon of global economies from humble starts. Much of that progress is thanks to the vast increases in human capital in each of these countries. By contrast, there are countries with considerable natural wealth that nevertheless have poor and moribund economies because they score badly on human capital measures.

Bakker et al. found that high human capital and strong governance play a crucial role in fostering high total factor productivity (TFP, a measure of productivity) in an economy.2 Given that TFP is a primary driver of economic output, high levels of human capital are key to strong rates of GDP per capita. Both theory and empirical evidence from a plethora of studies underpin the importance of human capital to an economy’s productivity.

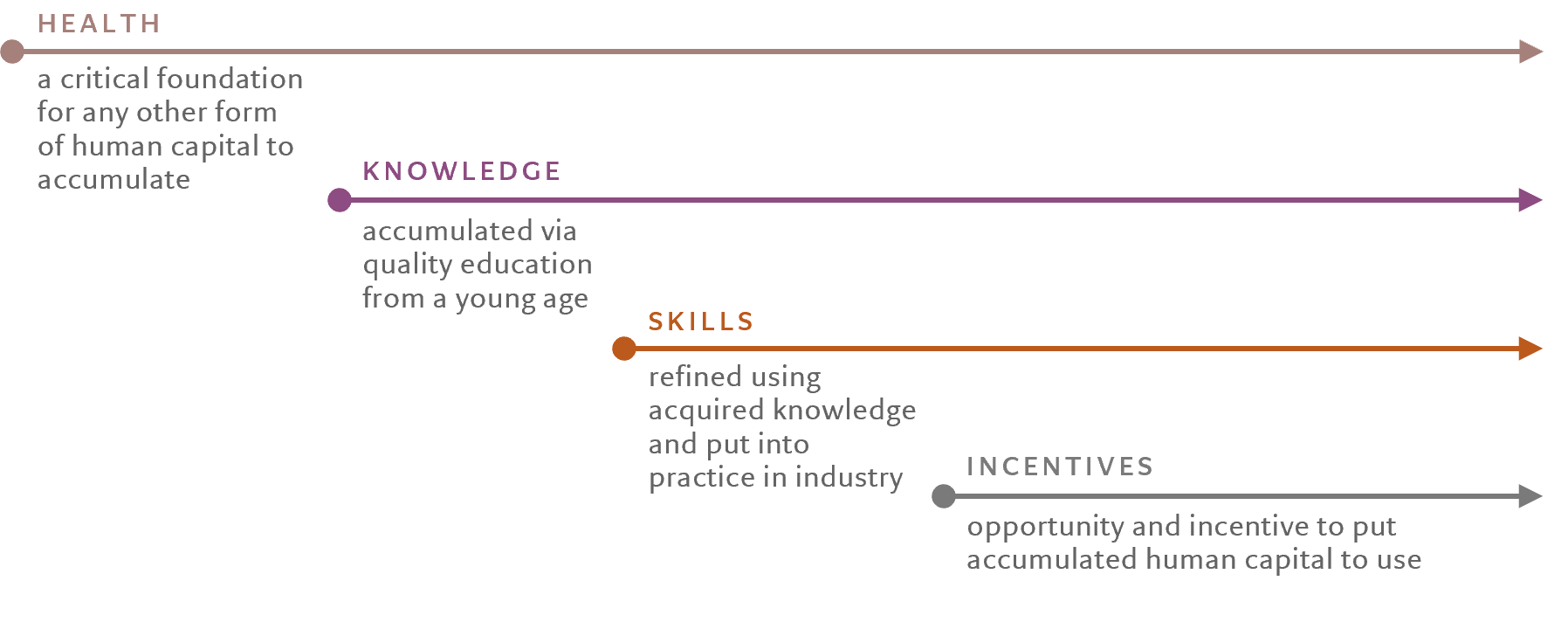

Figure 1 – Human capital lifecycle

Accumulation and translation into economic benefits

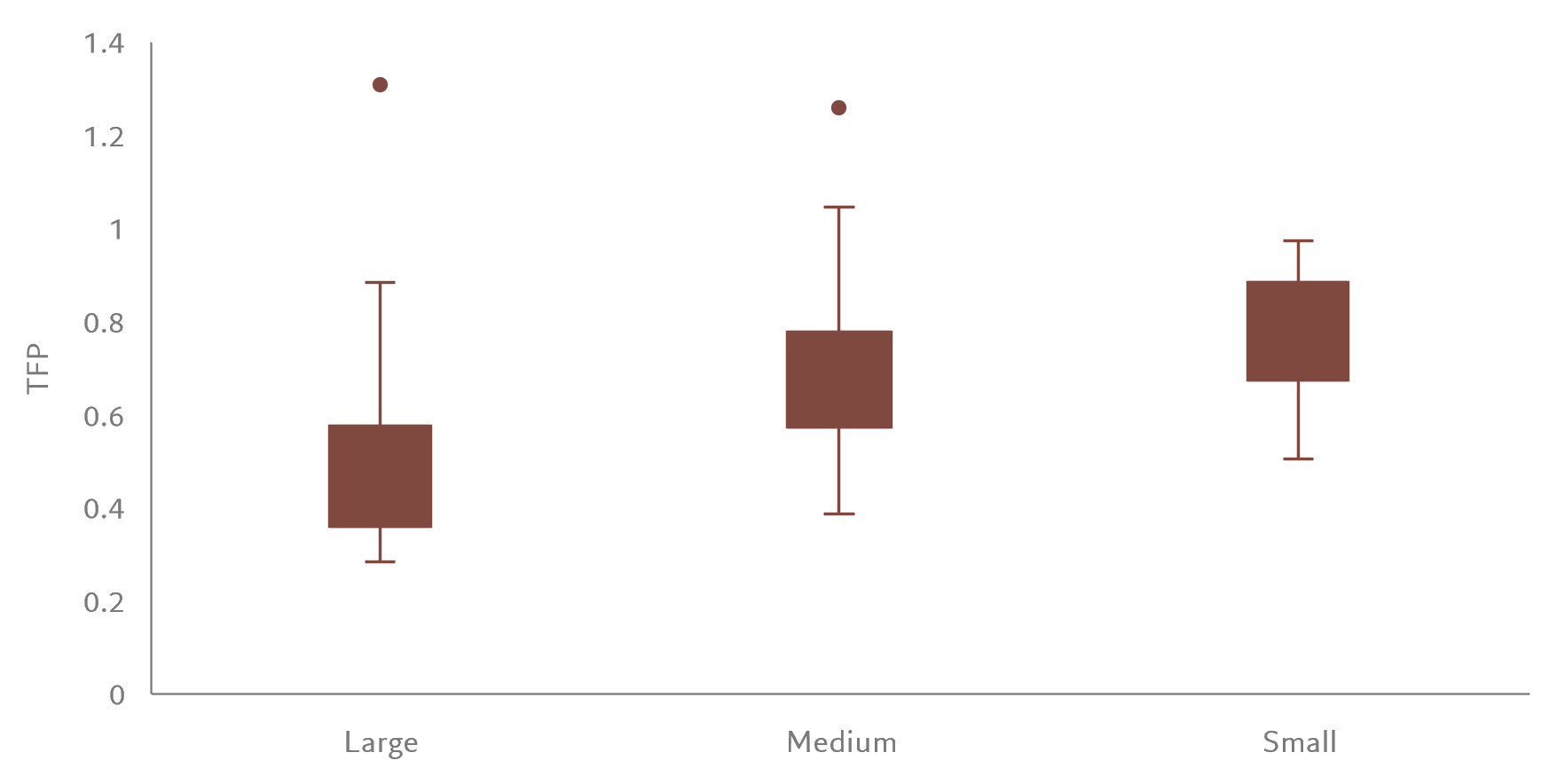

This is true across various measures of human capital. So, for instance, our own analysis shows that there is a significant link between average PISA scores3 and TFP. Countries where female life expectancy at birth is significantly lower are associated with lower TFP. Countries in which children suffer stunted growth – smaller in size – have lower TFP. Countries with higher rates of undernourishment have lower TFP. Countries in which smaller proportions of their population, male and female, live to 65 have lower TFP.

One only needs to look at the impact of the pandemic on students’ prospects to see how significant even moderate shifts in human capital accumulation can be. The World Bank estimates that “students could lose as much as 10 per cent of their future annual earnings due to Covid-related learning losses…equivalent to 17 per cent of today’s global GDP.”4

Wealth of nations

Given the link between economic output and human capital, developing human capital then becomes a crucial means for emerging economies to grow without placing an excessive strain on natural resources.

Economic development has historically largely been driven by industrial development, which has, in turn, been costly in terms of resources. For instance, the most advanced economies have incurred massive cumulative carbon debts by fuelling their industrial development with coal first and then oil. But that’s not the only model for economic growth – digitalisation and modern technology means that output can be generated in much less resource intensive ways. But people also need the skills to take advantage of cutting-edge technology, which is why it’s essential to build human capital.

Clean(er) development is already happening in other parts of the economy thanks to technological innovation. Take telecoms. With the advent of mobile telephony, less developed countries no longer need to make huge infrastructure spending to achieve widespread coverage. They just need a few well placed masts.

Figure 2 – Live longer, be more productive

Correlation between life expectancy gap of females (small, medium and large gaps) and a country’s total factor productivity (2017, dataset of 92 countries)

Height of the box represents the 25 to 75 percentile range. Bars represent 1.5 times below or above the inter-quartile range. Dots represent outliers.

So where the most advanced countries have reached high levels of development at the cost of breaching various planetary boundaries5, emerging economies have the potential to develop sustainably by unlocking human productivity by improving social foundations.

Some of these are very easy wins. Improving water quality and sanitation can have dramatically beneficial effects on health, not least in cutting child mortality, by reducing disease. Measures as simple and cheap as giving children deworming pills have been shown to improve educational attainment. Improved education and skills – not least female education – is a key driver of productivity gains in an economy, as is encouraging more women into the workforce.

Overall, improving survival rates, boosting life expectancy at birth and reducing undernourishment are an essential basis from which to build human capital. From there, it’s a matter of education: improving enrolment and completion rates at school, improving literacy and numeracy rates, getting more children through primary school to secondary and then tertiary studies. Education helps people build essential skills, which then helps to improve an economy’s labour force participation rate and pushes down unemployment.

Agents of change

A stable state with a leadership committed to improving its population’s welfare is an essential building block. Large scale interventions in both health and education depend on government expenditure and policies. But government action needs to be complemented by the corporate sector. Companies can help build human capital through infrastructure development, financial and digital inclusion and skills development and other.

At Pictet Asset Management, measures of human capital development are used to guide investment managers of our emerging market debt portfolios.

We seek to focus investments in countries that are making the most progress in addressing gaps in human development.

For us as investors, to uncover the best opportunities for return, we identify areas where human capital has the most scope to grow. Gaps are assessed using a set of indicators with defined thresholds where human capital gains can be measured and where enabling corporate sectors can be identified. This allows for regular assessment of sovereign interventions and human capital outcomes, bearing time lags in mind – some interventions have a relatively quick pay-back, others take a number of years. This then becomes the basis of an investible universe of both countries and companies.

Within the sovereign bond market, development gaps are first identified across health, education, skills and incentives. Countries with no significant gaps can be ignored as can those which haven’t made strides in closing their gaps or that have failed to adhere to the principle of doing no significant harm to the environment. Finally, analysis of policies being pursued by the remaining countries can help determine whether they are likely to close their development shortfalls. This involves a mix of both a quantitative and qualitative approaches to assess the strength of policy intention and alignment with UN sustainability goals and policy implementation.

‘Human capital is a hitherto ignored opportunity for investors, but it has the potential to be a rewarding one’.

Angola is a particularly interesting example. On the face of it, it has significant development gaps. But it also has huge potential beyond its vast reservoirs of natural wealth. For one thing, it has one of the highest fertility rates in the world, nearly half its population is under 15 years old, and its government recognises the need to diversify its economy from oil. To meet the UN’s sustainable development goals, it would need to increase spending in education by 8.3 per cent of GDP, health spending by 5.7 per cent of GDP and water and sanitation by 2.1 per cent of GDP. Doing so would give a significant boost to its human capital and thereby help to diversify its economy. It would also open up climate-resilient opportunities, not least in green power and harness the country’s demographic dividend.

But it’s not just a matter of looking at countries. Companies can make a difference by helping unlock human capital, for instance by facilitating financial inclusion. Here, it’s a matter of assessing and then measuring significant development gaps within certain areas such as any activity that credibly fills a development gap in any of the human capital dimensions in financials, telecoms, infrastructure, utilities, health care, education, etc., taking into consideration aspects such as accessibility, affordability and quality of goods and services.

Take finance – the first step is to consider what proportion of a country’s population has access to bank accounts and then at account ownership within individual financial institutions. Is there scope for growth? What are the banks doing to make financial services more widely available? What progress have they been making? A prime candidate for investment would be a retail bank that has a wide reach as a result of a diverse target market, which has technological solutions that can reach remote and underserved geographic locations.

It’s a virtuous cycle. By building human capital, companies reinforce the economic health of the countries in which they operate, which in turn creates more business opportunities and greater revenue for the corporate sector overall. Human capital is a hitherto ignored opportunity for investors – but it has the potential to be a rewarding one.

Amana Shabeer contributed to this article.

[1] We identify human capital as an accumulation of health, knowledge, skills and incentives, in line with definitions set out by Gary Becker and by the World Bank.

[2] Bakker et all, “The Lack of Convergence of Latin-America Compared with CESEE: Is Low Investment to Blame?”, IMF Working Papers, June 2020.

[3] Programme for International Student Assessment, which compares academic attainment of 15-year olds across the world through testing and scoring.

[4] https://www.worldbank.org/en/news/feature/2021/10/27/taking-a-comprehensive-view-of-wealth-to-meet-today-s-development-challenges

[5] The Stockholm Resilience Centre has defined nine planetary boundaries, environmental thresholds that, if breached, threaten human existence. These include the likes of freshwater use, climate change, change in biosphere integrity, ozone depletion, ocean acidification, land-system change and biogeochemical flows.