DIVERSIFICATION IS THE TRUMP CARD!

Phrases like “Don’t put all your eggs in one basket” are often heard when it comes to investing. This is because building a broadly diversified portfolio can help to master ups and downs in the capital markets, while at the same time creating greater resilience in the portfolio.

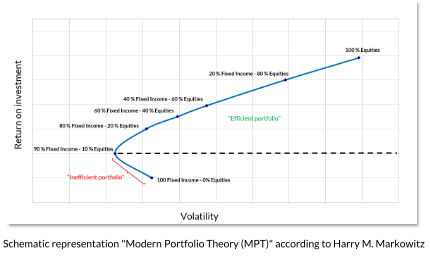

As a fundamental concept, Harry Markowitz’s portfolio theory has long helped investors diversify their portfolio risk and make optimal investment decisions. Portfolio theory assumes that investors are risk averse and therefore seek to maximize their return for a given level of risk or minimize their risk for a given level of return. Markowitz argues that this can be achieved by including a variety of investments in a portfolio that have different returns and risks.

A central concept in portfolio theory is diversification. By combining investments that are not perfectly correlated, the overall risk of the portfolio can be reduced. Markowitz introduced the concept of the “efficient frontier”, which represents all portfolios that deliver the maximum return for a given risk or the minimum risk for a given return. It can therefore be used to determine the optimal portfolio for an investor depending on his risk and return profile (see chart).

Markowitz’s portfolio theory has had a major impact on modern investment practice. Many institutional investors and portfolio managers use his methods to construct and manage portfolios. Diversification allows investors to reduce the specific risk of individual investments while taking advantage of the return opportunities offered by the market.

None of the aforementioned companies constitutes an investment recommendation. Past performance is not a reliable indication of future return and is not constant over time.

WILL BONDS ONCE AGAIN FULFIL THEIR TRADITIONAL FUNCTION AS PORTFOLIO

The historically rapid turnaround in interest rates initiated by central banks to fight inflation has meant that diversification a la Markowitz has not worked over the past year – both equities and bonds have seen losses. In the meantime, however, key interest rates are approaching their peak. Against the backdrop of an increasingly likely recession, bonds could play a greater role again, according to ODDO BHF AM analysis, because they now offer attractive yield levels in the medium to long term. This applies to both government bonds and corporate bonds. Instead of the paradigm of TINA (“There is no alternative”- to shares) that has prevailed since the financial crisis, the time of TAPA (There are plenty alternatives) is now beginning again. Especially when the correlations of asset classes such as equities and bonds return to the “gold standard” a la Markowitz, there is more choice again for mixed portfolios.

Discover de full Fund Insight d’ODDO BHF AM here.