Here is a new comment from Frederik Ducrozet, Head of Macroeconomic Research, at Pictet Wealth Management, on euro area wages following today’s (strong) number, and below a short summary.

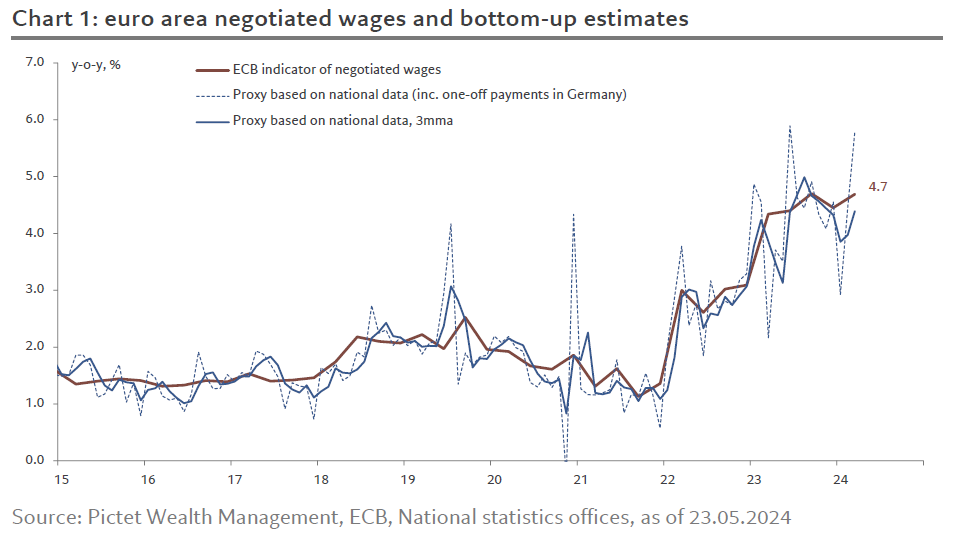

- Euro area negotiated wage growth surprised to the upside in Q1, rising to 4.7% YoY from 4.5% in Q4 2023. Germany was the only driver for the stickiness in wages, reflecting the delayed effect of recent wage deals catching up with higher inflation.

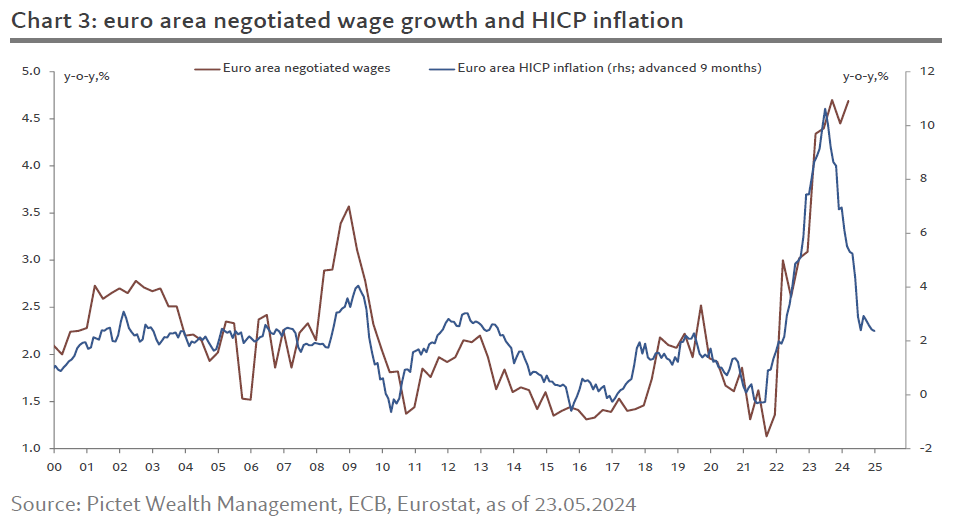

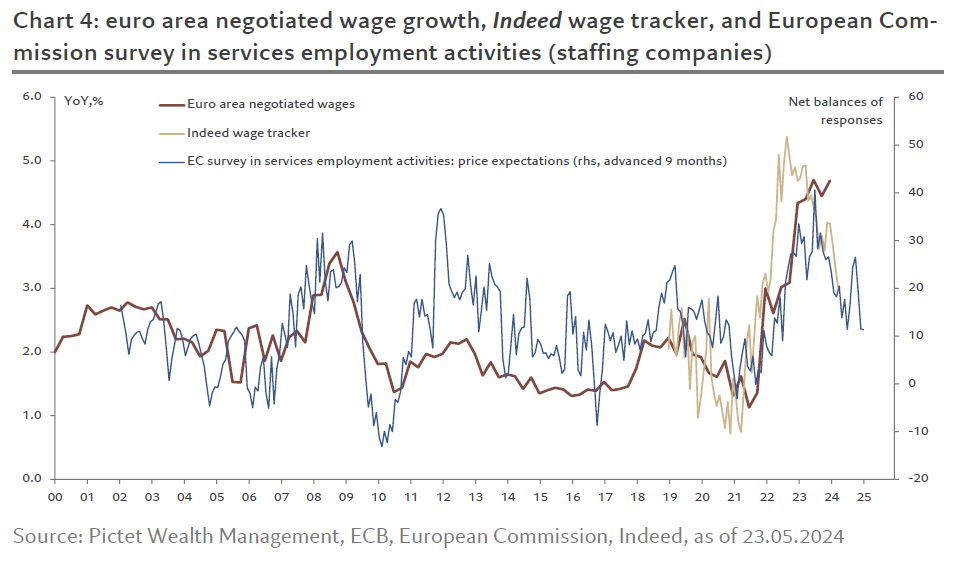

- Looking ahead, we argue that the disinflation process remains firmly on track, and that concerns over a wage-price spiral are misplaced.

- That said, given the noise and the lags in wage data, the ECB is likely to move slowly initially before it becomes more confident that inflation is converging towards the target over the medium-term. We expect the ECB to cut rates in June but pause in July, before resuming its easing cycle in September.