You will find below a commentary by Frederik Ducrozet, Head of Macroeconomic Research at Pictet Wealth Management, following today’s ECB meeting.

- As expected, the Governing Council (GC) remained on hold today. However, discussions on the “unwinding of the restrictive stance” have begun and President Lagarde’s comments during the Q&A session confirm our base case that the ECB will cut rates in June.

- The key takeaway from the meeting is that the GC is approaching the point where it has sufficient confidence that inflation will return to the 2% target, a necessary condition for the easing cycle to begin.

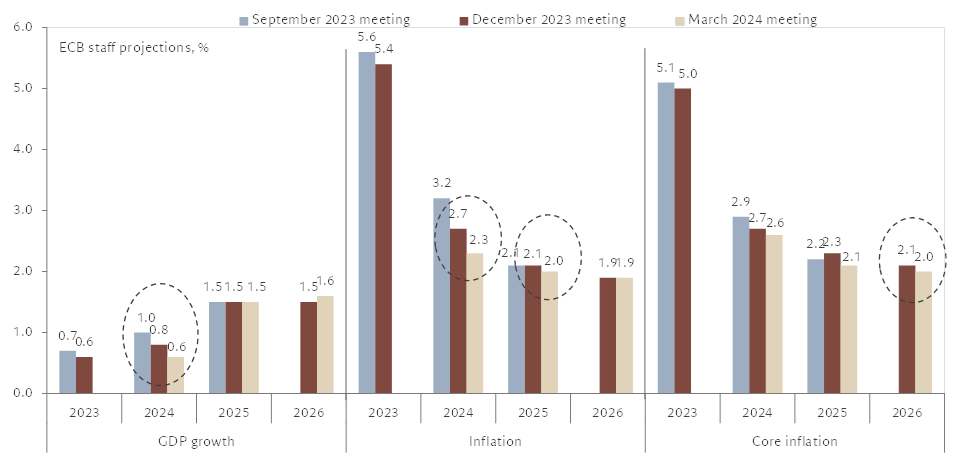

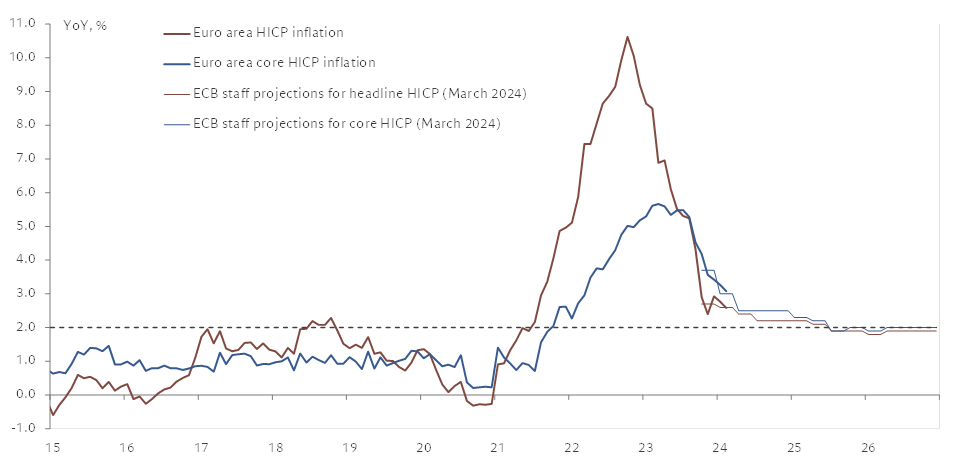

- The ECB staff projections were revised slightly lower than expected. Headline HICP inflation is now projected to return to 2% in 2025, while core HICP inflation would normalise to 2% by 2026, with the quarterly profile showing both headline and core HICP inflation declining to 1.9% in the third quarter of 2025. These projections are consistent with price stability over the medium term, especially since the ECB moved to a symmetric 2% inflation target in 2021.

- In addition, the introductory statement noted that “most measures of underlying inflation have eased further”. The wording was unchanged from the January meeting, suggesting that there was no undue concern about the sequential pick-up in core services inflation recorded earlier in the year.

- Finally, Lagarde noted that there were “signs that wage growth is beginning to moderate”, while elaborating on various measures of labour costs, corporate profit growth and their relationship to inflation. We will know more on this front tomorrow with the second estimate of euro area GDP for Q4 2023.

- Lagarde said that the Governing Council had not discussed cutting interest rates today but had only just begun to discuss “unwinding its restrictive stance”. A subtle distinction, if any. But then the President dropped a more explicit hint about the timing of the first cut, saying that “we will know a little more in April, but we will know a lot more in June”. That’s as far as she can go in terms of signaling the first cut, adding that market prices seemed to be converging better. In short, everything now points to the ECB cutting rates in June, in line with our scenario.

- Where uncertainty remains, however, is the pace of easing once the cycle starts. Lagarde said that the ECB is in the “holding” phase before moving to “restrictive” followed by “normalisation”. In other words, she didn’t give anything away as the ECB will remain data dependent, looking at various measures of underlying inflation trends. There is also considerable uncertainty about where the neutral rate is.

- We continue to expect the ECB to move cautiously in 2024, most likely pausing in July after a cut in June and moving to an easing pace of 25bp per meeting from September. However, the subdued outlook for domestic demand, not least due to “predictable policy transmission”, and a more restrictive fiscal stance than in the US point to further monetary easing into 2025. That’s where the potential for market repricing seems greater.