Below you will find a new comment from Xiao Cui, Senior Economist, at Pictet Wealth Management, following today’s US GDP report.

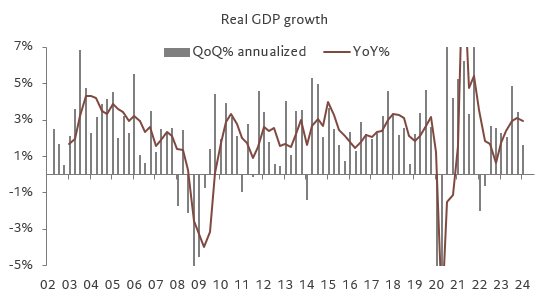

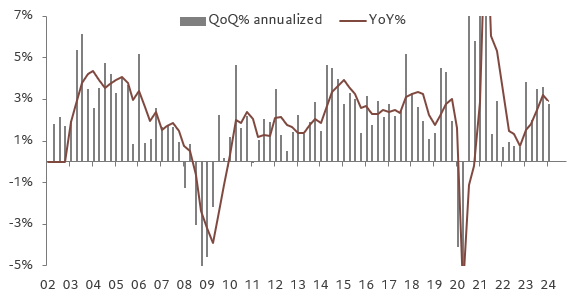

Real GDP in Q1 came in below all forecasts on BBG, slowing to 1.6% QoQ annualized (vs. consensus of 2.5%) from 3.4% in Q4. However, stripping out the volatile trade and inventories, domestic final sales, a better gauge of final demand, grew at a robust rate of 2.8%, slowing only marginally from 3.5% in Q4.

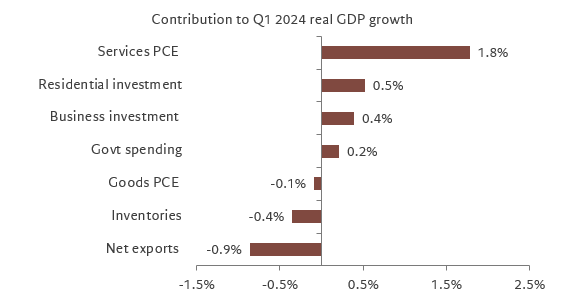

Relative to expectations, part of the downside surprise was driven by net exports, which subtracted a hefty 0.9% from headline growth. The drag was due to slowing exports and strong imports, itself an indication of solid domestic demand. Consumption growth also came in a touch weaker than expectation, slowing to 2.5% (consensus: 3.0%) from 3.3%. However, all the slowdown was in goods spending, which contracted for the first time in six quarters. Services consumption growth powered ahead to a strong pace.

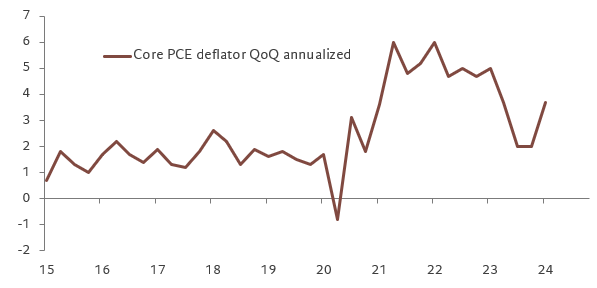

Importantly, quarterly core PCE inflation came in at 3.7% QoQ annualized, above consensus expectation (3.4%) and up sharply from its slow pace in Q4. This introduces upside risks to tomorrow’s monthly PCE inflation data, where core PCE could come in at 2.8% YoY or higher (against expectation of 2.7%). There is much uncertainty surrounding intra-quarter revisions, which would dictate the exact inflation path. (Assuming no revisions in January and February (a bold assumption), the quarterly print implies a monthly core PCE inflation reading for March of 0.48% MoM, much higher than consensus expectation of 0.3%)

Overall, the US economy continues to grow at a solid pace despite monetary constraint. Meanwhile, inflation risks stalling out and becoming stuck at a higher level than expected before. Solid domestic demand and upward revisions to inflation suggest the Fed will take an even more patient approach to policy adjustment. At the FOMC next week, we expect a hawkish hold where Chair Powell would signal the data suggest later and fewer cuts. We expect gradually slowing inflation and a modest slowdown in demand (to a still solid pace) to get the Fed to ease twice this year, but risks are skewed towards later and fewer cuts. We continue to expect the bar for a rate hike this year to be high. If Powell sounds more open-minded about such a move next week, that would be a hawkish outcome.

Details of the GDP report are stronger than headline suggests.

- Consumption remains the main driver of growth as services spending accelerated. Goods spending contracted due to weakness in durable goods.

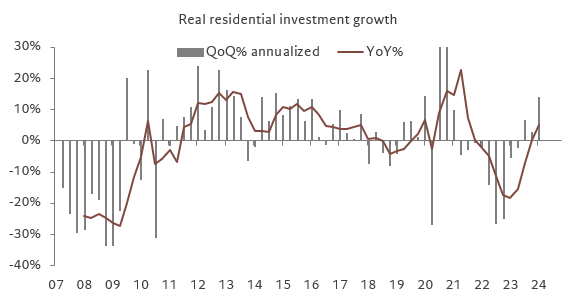

- Residential investment grew for the third consecutive quarter, and is now adding more visibly to growth (0.5% boost).

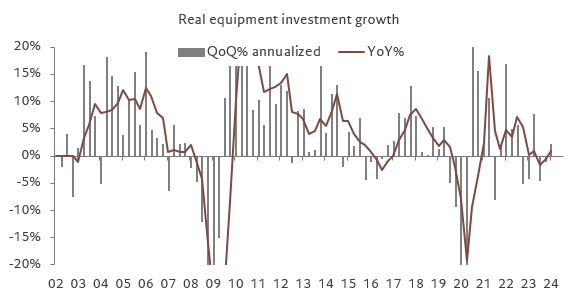

- Business investment remained anemic, as structures investment (partly driven by the Inflation Reduction Act) lost momentum after four quarters of double-digit growth and contracted. Equipment spending grew after two quarters of contraction, but growth remains modest.

- Government spending, at both federal and state and local level, saw decelerating growth after a strong year.

- Inventories contracted for the second consecutive quarter, subtracting 0.4% from GDP. Inventories tend to mean revert and recent drag suggests upside risks to growth in coming months as firms restock.

Chart 1. Real GDP growth

Chart 2. Q1 Real GDP growth contribution by detailed spending categories

Chart 3. Real final domestic sales growth (GDP ex trade and inventories)

Chart 4. Core PCE deflator

Chart 5. Real residential investment – second consecutive quarter of growth