Peter Rawlence, Investment Manager, Pictet Asset Management.

Corporate engagement is useful addition to the responsible investor’s toolkit.

Grassroots campaigns are woven into the history of environmental and social reform.

In the US, they have played a crucial role in the introduction of transformative welfare and healthcare provision, clean water legislation and wildlife protection laws. They have enjoyed a similar degree of success in Europe.

How curious, then, that within the world of responsible investment, the equivalent strategy – harnessing shareholder power to bring about improvements in company behaviour and business strategy – has been a low priority for most investors.

One explanation for the lack of enthusiasm is that the alternatives to corporate engagement appear to have a more immediate impact.

Avoiding ‘bad’ companies altogether or investing exclusively in firms that operate in sustainable industries both give the impression of being more effective and easier to deploy.

But on closer inspection, a more complicated picture emerges.

Allocating capital to listed businesses specialised in, say, green technology or social care, makes sense only up to a certain point. Once a stock price fully embeds a company’s environmental or social premium, it becomes expensive. That reduces the scope for additional investment returns.

Many of the listed firms with strong social or environmental credentials are already trading at high price-earnings multiples, in our view. Which means investing in such shares might not always make financial sense.

Divestment – or excluding sin stocks – has rather more serious drawbacks. A report by Pictet, Retraites Populaires and the Enterprise for Society Center (E4S) showed that the effects of divestment often run counter to investors’ aims.1

The study, which focused mainly on corporate carbon emissions, found that divestment failed to incentivise highly polluting firms to adopt sustainable business practices.

The same report also concluded that excluding ‘dirty’ companies from portfolios had little or no effect on such firms’ capital costs or access to finance, contradicting what advocates of divestment policies claim. This was particularly true for firms operating in the energy sector.

“Many of the listed firms with strong social or environmental credentials are already trading at high price-earnings multiples. Which means investing in such shares might not always make financial sense.”

Engagement – a crucial aspect of the transition

The limitations of divestment and targeted capital allocation are not the only arguments in favour of corporate engagement. Engagement is essential because, deployed judiciously, it can improve the sustainability of businesses that score poorly on ESG metrics but are nevertheless crucial to the transition, such as mining, utility and energy companies.

It is for these reasons that investment managers of Pictet Asset Management’s Positive Change strategy put engagement at the heart of their portfolio construction process. The team invests in companies that are central to the building of a sustainable economy but whose potential contributions to that effort are not fully appreciated by the market at large.

The investment managers deploy engagement with two broad goals in mind, both aimed at enhancing investor returns. The first is to steer businesses towards improving the alignment of their products and services with a sustainable economy, or “doing the right things”. Here, we focus on companies that are either already making a contribution to the green transition or whose products and services have a clear social benefit. The engagement can involve urging companies to expand upon their positively-aligned activities. But it can also see us calling on the same companies to curtail activities that are negatively aligned with sustainable development goals.

The second objective is to encourage companies to improve their ESG credentials and mitigate ESG risk – or “doing things right”. This could involve embracing business practices that, for example, reduce pollution, improve working conditions or optimise corporate governance.

Targeted engagement

The engagement process has several distinguishing features that make it an especially effective tool.

To begin with, it draws on – and is informed by – high quality data. We assess a company’s sustainability by analysing how closely its products and operations align with the United Nations Sustainable Development Goals (SDG).

SDG alignment can have a strong bearing on the performance of a company’s share price. According to our analysis, firms that succeed in aligning their operational set-up and products and services with the UN SDGs deliver superior investment returns over the long run. And we believe engagement can hasten a company’s progress along that path.

Another distinctive aspect of our approach is that it is targeted. We don’t enter into intensive discussions with every company that forms part of our investment universe. Rather, we only invest in and engage with businesses that demonstrate both the capacity and desire to change. Nor do we aspire to be an ESG generalist. We only give guidance on environmental and social matters for which we can claim genuine investment expertise.2

By following this process, we can devise bespoke engagement programmes, each containing what we believe are challenging – but feasible – objectives and mutually-agreed timetables for delivery.

Case study: Baker Hughes

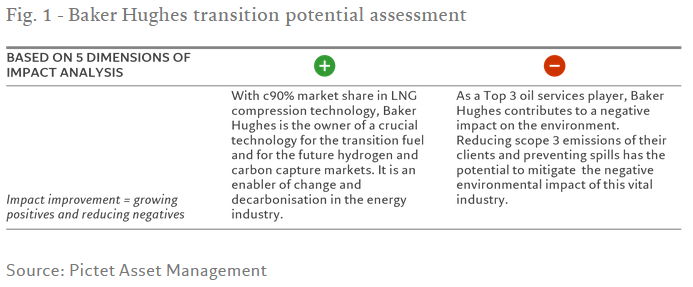

Our engagement programme with energy and oil services group Baker Hughes Co demonstrates how we apply these principles in practice. At first glance, the company doesn’t appear to be a natural choice for investors pursuing ESG objectives. It is the world’s third largest oil services firm and is a key technology provider for the natural gas industry. Yet a deeper analysis reveals something more promising.

The company was among the first in its industry to commit to halving its carbon emissions by 2030 and eliminate them completely by 2050. Moreover, our own assessments showed Baker Hughes could play an outsized role in the clean energy transition thanks to its growing climate technology business.

Our engagement plan required the company to make meaningful progress on three fronts. First, it would need to invest more in its green technology solutions. Second, it would have to accelerate efforts to reduce the lifetime carbon footprint of its products in use. The third requirement was the establishment of tougher oil spill reduction targets. In early 2022, we made our case in person to the group’s chief financial officer – a discussion which led to additional meetings with other senior executives, including Baker Hughes’ chief executive officer, chairman and chief sustainability officer. The response to our proposals was overwhelmingly positive – we found company very willing to engage on every aspect of our transition plan.

We consequently bought a stake in the company at the launch of our strategy in 2022.

Since then, the company has delivered significant progress towards meeting our objectives. In recent months, it has expanded its monitoring and reporting of Scope 3 carbon emissions – which includes those of its suppliers and customers – and said it would announce new more ambitious scope 3 reduction targets later this year. Regular disclosures on spills has also improved. Perhaps most encouraging of all, the company announced a 60 per cent increase in investment in its industrial technology business – which is crucial to the development of both clean hydrogen and carbon capture.

Baker Hughes is not an isolated case.

Since the launch of the Positive Change strategy in June 2022, we have been pursuing 19 engagement objectives with approximately one in three of the companies we invest in. Those engagements are either directly led by our investment managers or in collaboration with internal and/or external parties.

We believe that it is through engagement activities such as these that the investment community can aid or hasten the transition to a more sustainable economy. As long as corporate engagement is deployed in the right way, there is no reason why it can’t enjoy the same success as the grassroots campaigns that have transformed society. Responsible investment without engagement isn’t very responsible at all.

[1] See: https://e4s.center/news/divestment-it-is-hard-to-do-well-while-doing-good-latest-e4s-report-shows/

[2] The Positive Change strategy also draws on expertise of PictetAM’s thematic investment portfolio managers and analysts, who have been managing environmentally-oriented investments at Pictet for several years. These investment professionals have acquired extensive knowledge of the environmental tech, water, clean energy, timber and agriculture industries in particular. Our engagement programmes are also informed by the views of Pictet’s external research partners, which include organisations such as the Stockholm Resilience Centre.