Utility companies are essential to the green transition. Which means climate focused investors cannot afford to ignore them.

Jennifer Boscardin-Ching, Client Portfolio Manager Pictet Wealth Management.

Power utilities attract controversy for their outsized impact on climate change.

Not only is the sector responsible for a third of global carbon emissions, but it has also recently drawn criticism after several energy companies restarted coal-fired plants as a consequence of the war in Ukraine.

Presented with this, climate-conscious investors might be tempted to remove power utilities from their portfolios.

Yet doing so would be counter-productive. Depriving such firms of capital endangers the net-zero transition.

In eliminating their own emissions, utility companies can play a crucial role in the decarbonisation of other energy-intensive industries.

If power companies can reduce their carbon footprints, so too will their customers in the transport, manufacturing and construction industries.

We realise that not every utility is fully committed to the green transition. Yet we see evidence that an increasing number is taking this responsibility seriously.

Some of the most progressive firms are going to great lengths to de-carbonise their own operations. Many are also ramping up investments in renewables and electricity grids.

But these changes don’t just benefit the environment.

The shift to a low carbon business model can be a profitable one too.

Utilities that fully embrace decarbonisation can benefit from a boost to earnings as renewables growth prospects improve.

What is more, those firms that phase out traditional thermal power plants also avoid the possibility of having to write down the value of fossil fuel assets that become obsolete.

All of which means utilities stocks could become a rich source of “transition alpha” in the years ahead.

Green journey

The world has a lot riding on the decarbonisation of the global power system as this, combined with the electrification of road transport and buildings, has the potential to halve global greenhouse gas emissions.1

The sector’s Scope 1 emissions – or those that stem from their operations and the resource they own or control, such as carbon dioxide produced by a coal power plant – represents Scope 2 emissions for other industries, or those that result from purchased energy.2

For example, when a car manufacturer purchases electricity from a power utility, its Scope 2 emissions are effectively the utility’s Scope 1 emissions.

This means if utilities rid their Scope 1 emissions of fossil fuel, they are effectively cleaning up Scope 2 emissions of other sectors at the same time.

We find that, in many cases, power utilities are meeting, or sometimes exceeding, expectations on their transition plans.

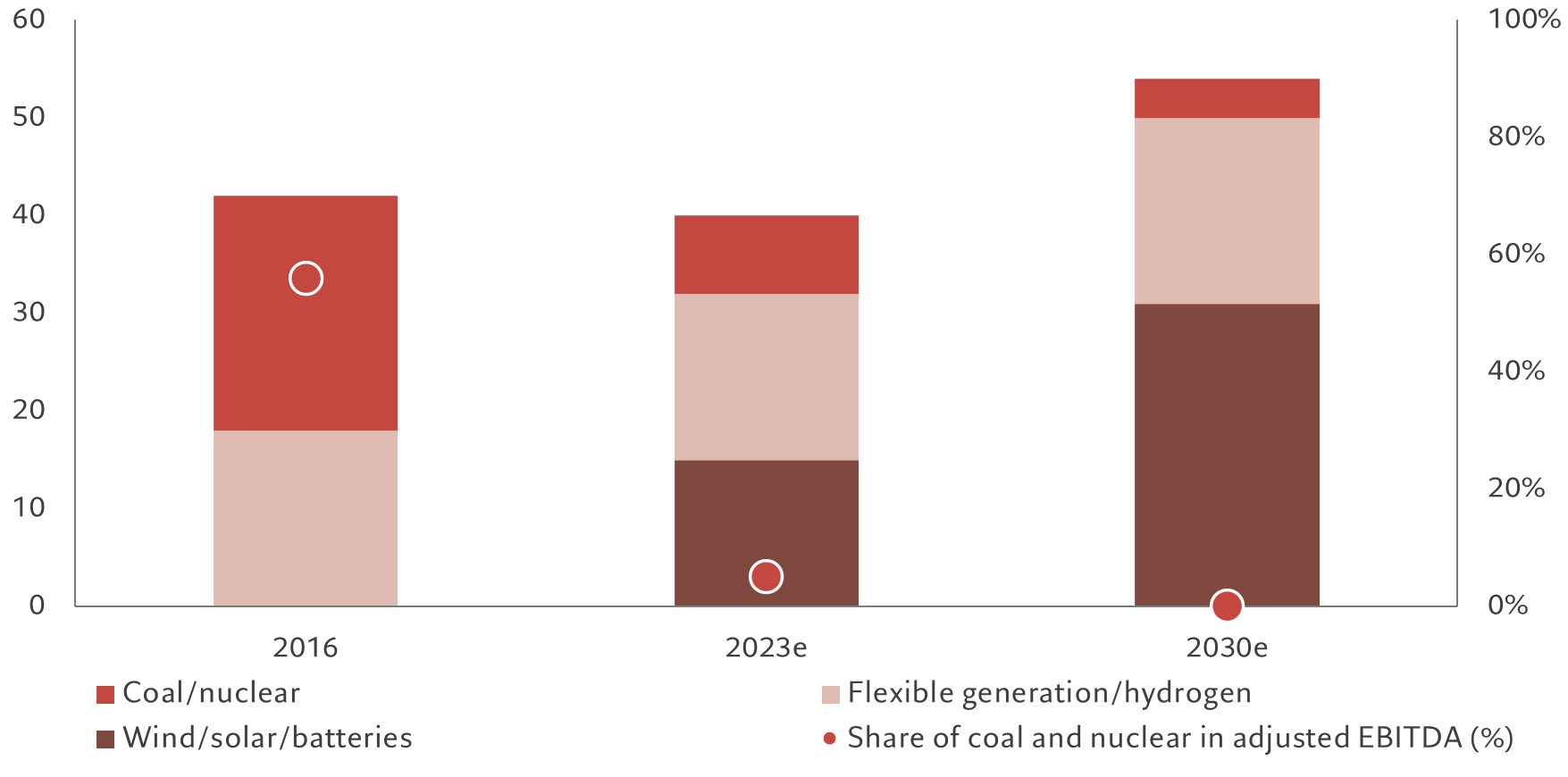

In Europe, for example, one utility firm has increased its share of renewables to 80 per cent of its installed net capacity, or 32 gigawatts (GW), in 2023, compared with 42 per cent in 2016 (Fig. 1). It also plans to phase down coal and nuclear activities in the coming years. By 2030, all of its earnings are expected to come from non-fossil sources.

Fig.1 – Case study, company A

Installed net capacity (GW) pro rata

Source: Company presentation as of 15.11.2021It is also planning to spend more than EUR4.5 billion every year until the end of the decade on green projects by redirecting cash flows from operating activities.

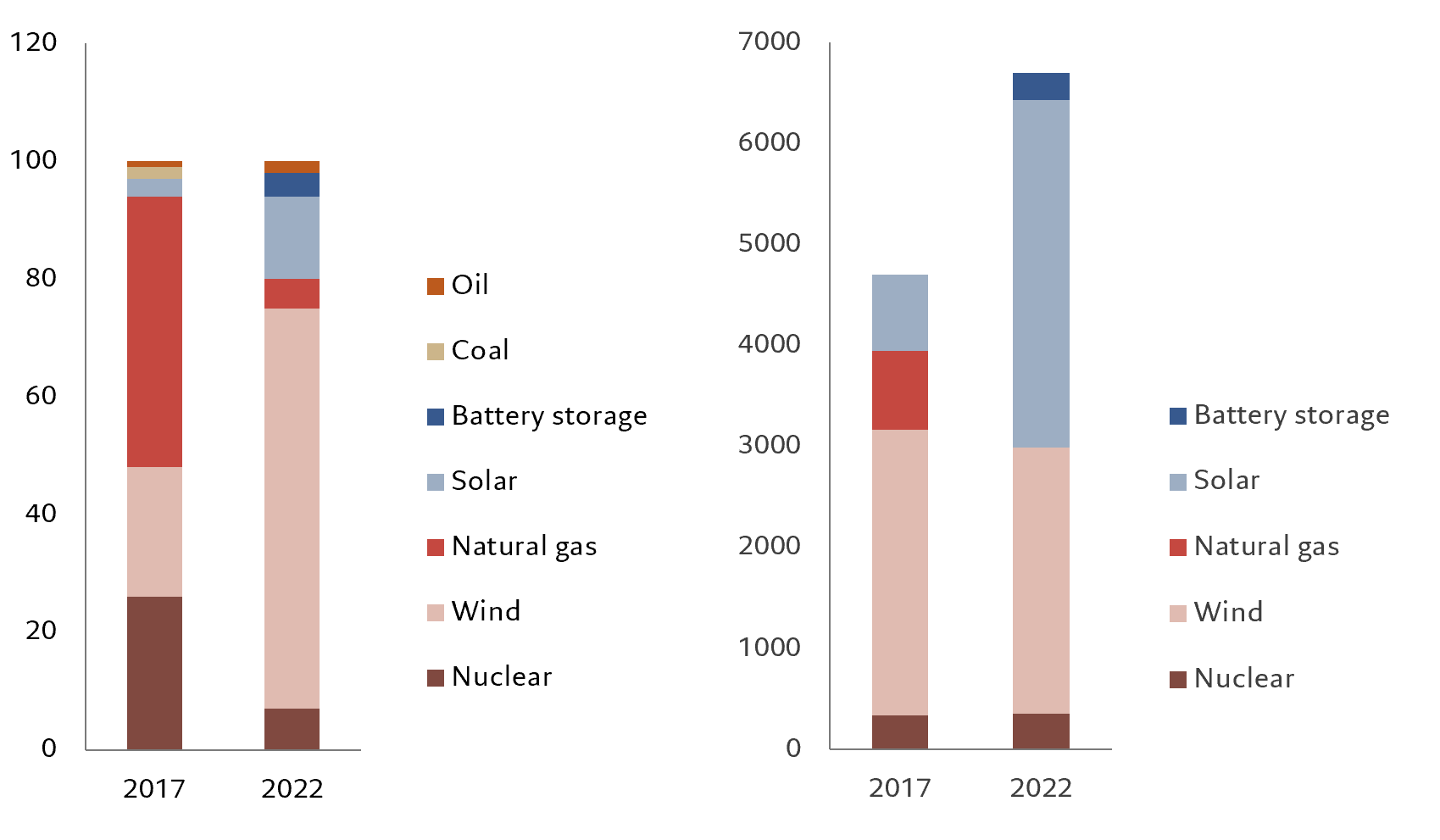

A US-based utility giant, meanwhile, has more than tripled its generation capacity of renewables such as wind and solar in the five years to 2022 (Fig.2).

It has a weighted average of 93 per cent of planned growth (as opposed to operational) capital spending, or USD78 billion, committed to green projects in the four years to 2025 which also includes battery and hydrogen storage. What is more, the firm plans to eliminate all Scope 1 and 2 carbon emissions across its operations by 2045 at no incremental cost to customers as it aims to benefit from the decarbonisation of the US economy, which it says represents a USD4 trillion market opportunity.

Fig. 2 – Case study, US utility firm

Generation (MWh) and capital expenditures (USD mln)

Source: Company annual report 2022Another European utility firm has closed 17 coal and oil thermal power stations since 2001 and reduced its emissions intensity, as measured by gCO2/KWh, by over two thirds since 2007. It plans to spend EUR36 billion in organic investments in the energy transition between 2023 – 2025. The company expects its EBITDA and its net profit to grow 8-9 per cent on a compound annual basis in the coming two years.

These three firms are not isolated examples.

Improving economics and increased focus on sustainability from consumers and investors are pushing utilities towards shifting power generation away from fossil fuel sources.

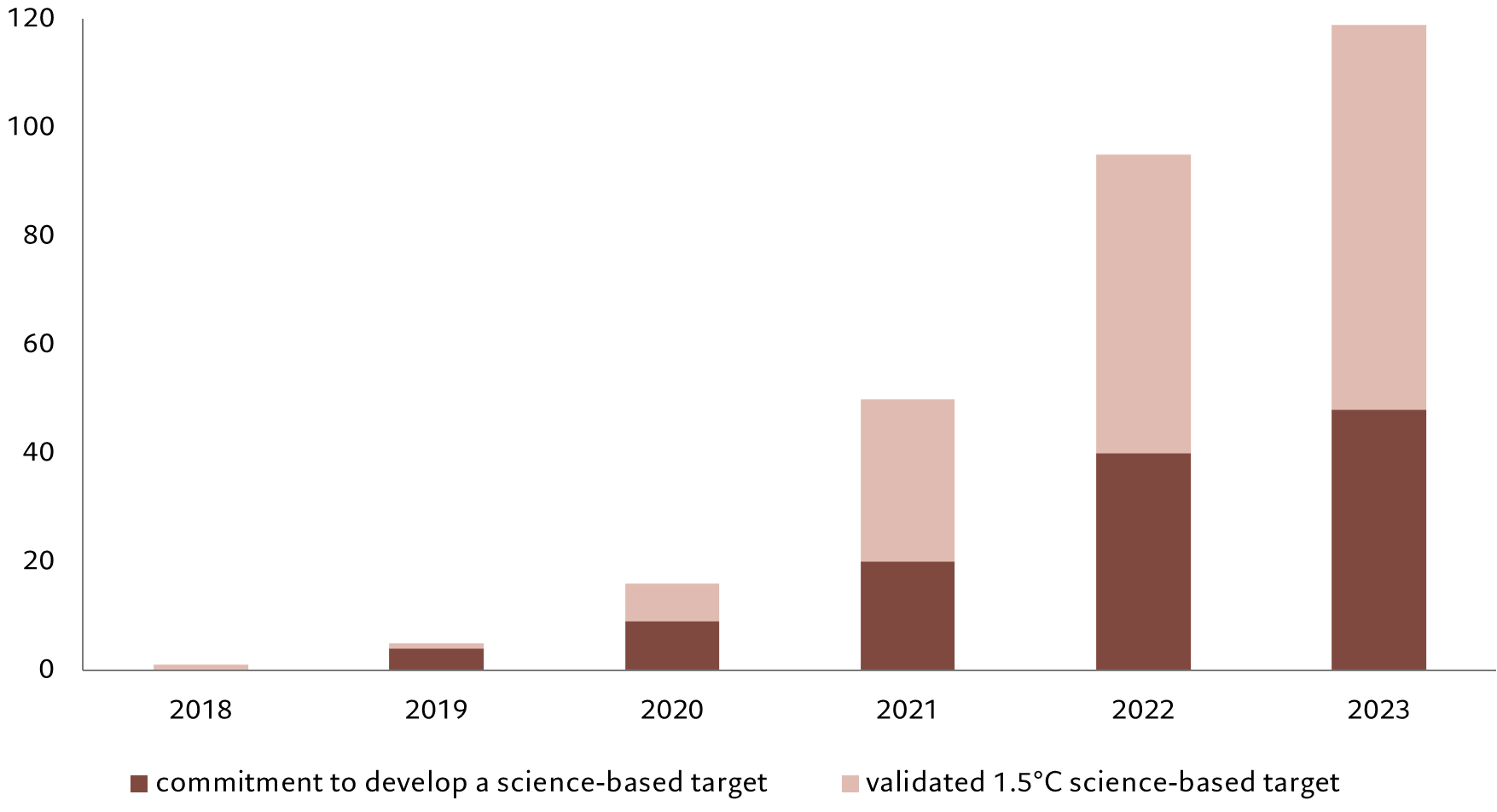

The number of utilities and independent power producers committed to the Science Based Targets initiative (SBTi) – an organisation validating corporate net-zero targets – has grown six-fold in the past three years alone.

Fig. 3 – Clean commitment

Cumulative number of electric utilities and independent power producers committed to SBTi

Source: SBTi 2023

Transition alpha

The changing dynamics of the utilities industry have important implications for investors.

As their business becomes “cleaner”, companies will be able to profit from higher growth and reduce transition risks, which can lead to outperformance.

A recent study shows utilities that generated less carbon power and spent more on low-carbon investments outperformed an equal-weighted portfolio of US sector peer stocks by 32 per cent over the past five years.3

The widening divergence in performance within the sector also highlights the rapidly changing nature of utility stocks.

A highly regulated sector with long-term contracts, utilities have traditionally been associated with stable, defensive and bond-like returns. But they are now increasingly offering an element of growth, driven by the acceleration in renewables and grid investments.

What is more, their strategies are often in line with government priorities, allowing them to tap into additional financing incentives and invest even more in the long term.

In other words, certain utilities allow investors to capitalise on the growth of the renewable energy sector while securing stable cash flows and long-term visibility on earnings.

As their business becomes ‘cleaner’, power utilities will be able to profit from higher growth and reduce transition risks, which can lead to outperformance.

Investors, too, can help accelerate utilities’ decarbonisation efforts.

At Pictet Asset Management, through active ownership and engagement, our investment managers:

- ask the companies to have their decarbonisation targets validated by the Science Based Targets initiative (or similar third-party verifiers), which develops guidance on transition best practices

- encourage companies to incorporate mid-/long-term emission reduction targets in the remuneration of management with penalties/incentives

- engage with companies to target an orderly shift in the generation mix, for example by retraining workers in the fossil fuel industry towards clean energy skills and avoiding a simple disposal of dirty assets.

Utilities are powerful contributors to a shift towards a decarbonised economy.

Leaders of decarbonisation should reap rewards from their investment to phase out fossil fuel sources and also offer investors attractive long-term opportunities.

[1] https://www.wri.org/insights/4-charts-explain-greenhouse-gas-emissions-countries-and-sectors

[2] For more details, click on https://am.pictet/en/globalwebsite/global-articles/2022/expertise/thematic-equities/understand-emissions-for-climate-risk#overview

[3] Based on CO2 intensity of power generation and clean capex (the share of clean energy investments in current-year capital spending) Bloomberg, 27.03.2023