Big decline in inflation puts pressure on the ECB

Nadia Gharbi, Senior Economist, Pictet Wealth Management.

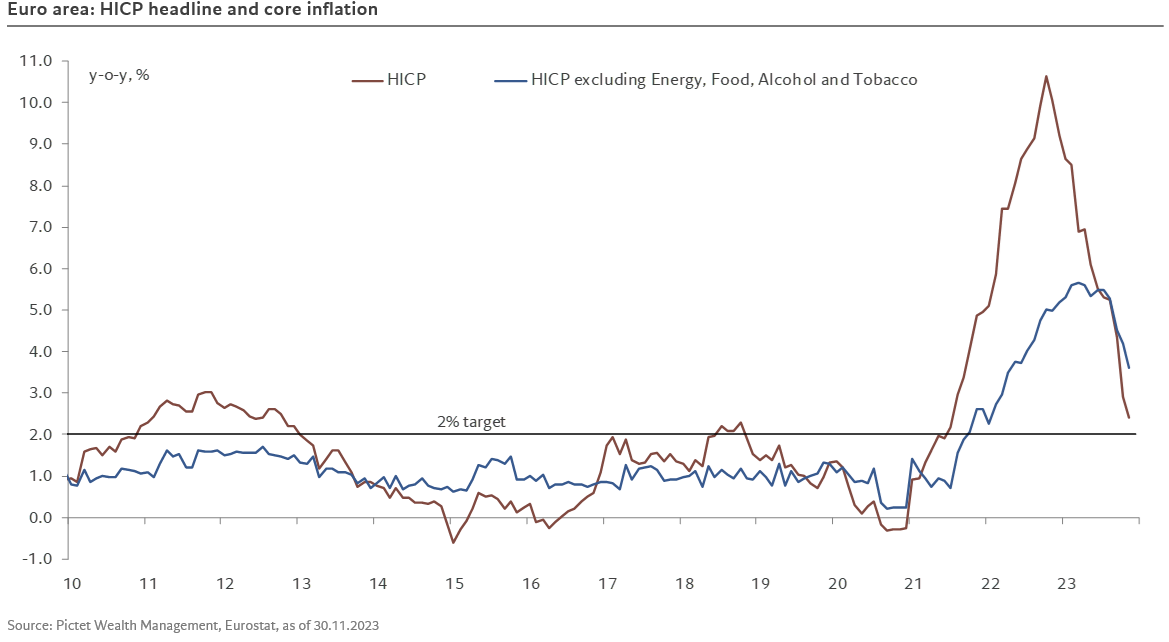

- Eurostat’s flash estimate of euro area headline inflation eased to 2.4% y-o-y in November from 2.9% the previous month, while core inflation moderated to 3.6% from 4.2%. The decline in core inflation was faster than consensus expectations (3.9%) and a touch more than our own forecast (3.7%).

- Services and core goods inflation eased by 60bp to 4.0% and 2.9%, respectively. Aside from core prices, food and energy inflation also moderated in November (full breakdown will not be published until December 19).

- Looking ahead, headline inflation is expected to pick up somewhat in December, while core inflation is expected to continue to ease gradually.

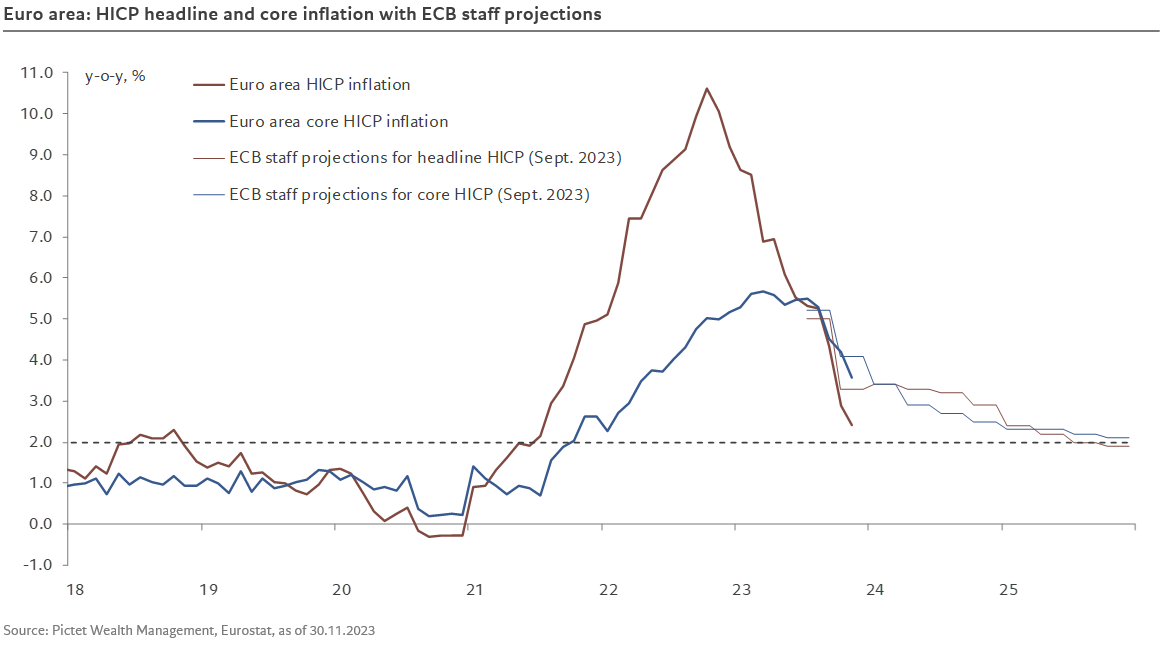

- From a monetary policy point of view, November’s data will be very hard for the ECB hawks to dismiss. It’s a fact; inflation is decreasing much faster than the ECB has been forecasting (see chart below), thus increasing the pressure on it to cut rates. We have pencilled in a first rate cut for June 2024, but the risks are tilted towards an earlier date.

- The focus at the ECB’s next policy meeting in December will be how much inflation forecasts are adjusted in the near term and out to 2026. Christine Lagarde (and the hawks) will probably continue to focus on wage growth’s impact on inflation. But wage growth is a lagging indicator and we believe we have seen the peak.