US Employment: If last month was goldilocks, this month is re-acceleration

Below you will find a new commentary by Xiao Cui, Senior Economist Pictet Wealth Management, on US employment.

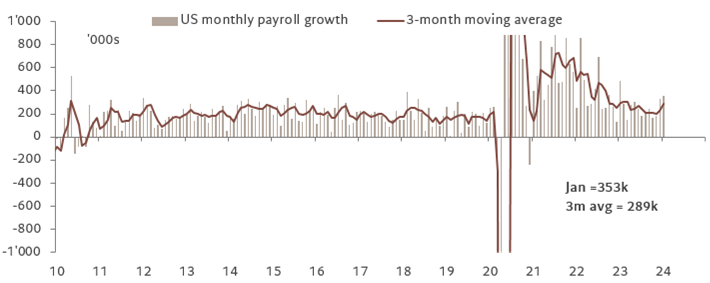

Nonfarm payrolls blew street forecasts out of the water, coming in hot at 353k (vs. expectation of 185k). For a change, there were upward revisions to past months and the annual benchmark revisions showed an acceleration in job gains in H2 2023. The three-month average pace of payrolls is at 289k vs. 165k as reported in December. January is typically a noisy month for payrolls due to large seasonal adjustment. Actual jobs fell by 2.6m, but they normally fell by even more so the seasonally adjusted job gains were 353k. The adjustment this month does not look excessive compared to history .

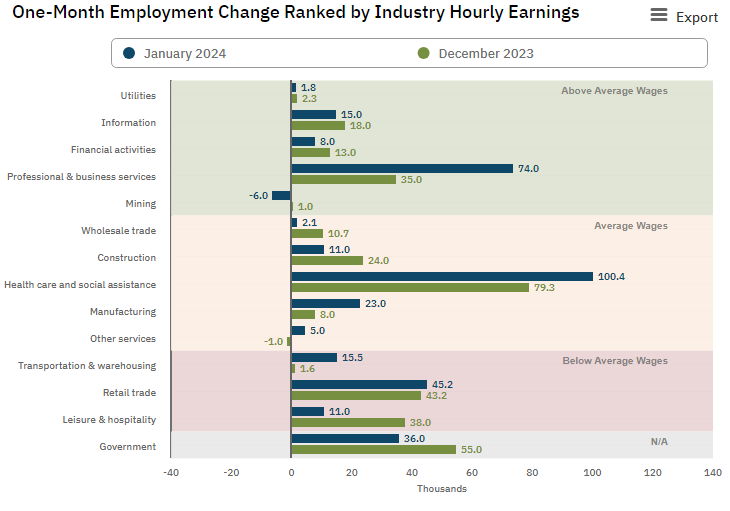

The breadth of job gains also improved this month, and for the past few months from the revisions. The re-acceleration in payrolls was broad based, with particular strength in professional and business services, retail, and healthcare. Temporary help workers, the most cyclical type of employment, rose slightly after 21 months of contraction.

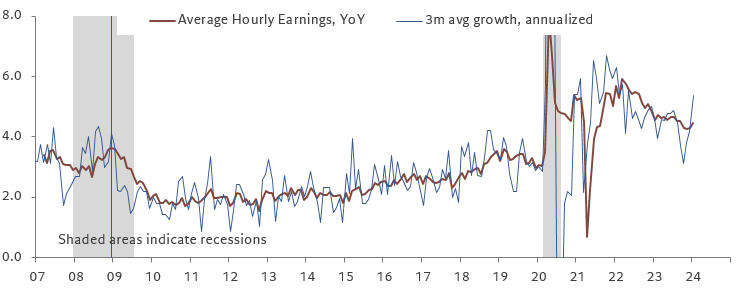

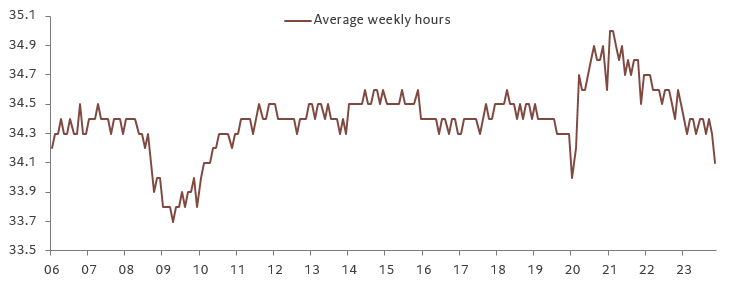

Wage growth also reaccelerated, growing 0.6% MoM, matching the largest monthly gain since the pandemic. The YoY growth rebounded to 4.5% from an upwardly-revised 4.3%, a level still higher than what would be consistent with a 2% target. The only thing not to like in today’s numbers is the sharp drop in average weekly hours, which fell to the lowest level since the pandemic. Employers are choosing to hang on to workers but reduce their hours, as the pandemic supply shortage earlier resulted in greater reluctance to layoffs. This is also typical pre-recessionary behavior but with other labor market data generally healthy, we would read it as sign of continued labor hoarding.

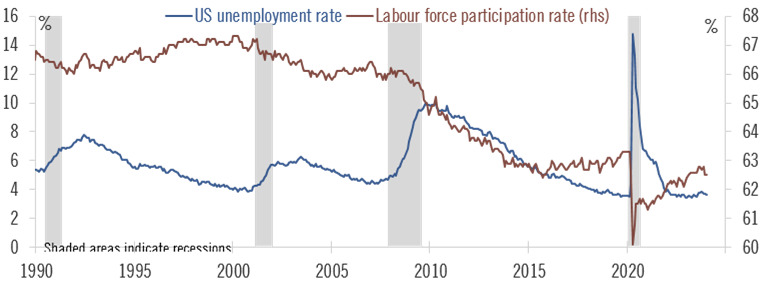

The household survey was solid, but didn’t show an acceleration. After adjusting for population controls (an annual practice in January), employment rose by 239k. The labor force participation rate remained unchanged after large declines earlier, and the urate stayed low at 3.7%. solid Although the unemployment rate stayed unchanged at 3.7%. The U6 underemployment rate rose for the second consecutive month, reflecting an increase in part-time workers for economic reasons.

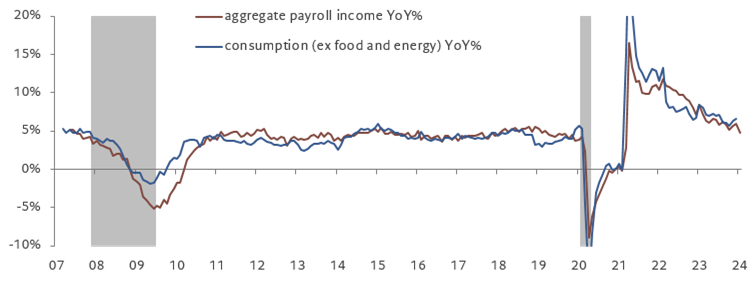

It’s too early to conclude that the labor market is heating up again, given other data showing a general trend of cooling. But the report does raise the risks of the economy reaccelerating, which at this point wouldn’t lead to further rate hikes. But they would certainly push bets on rate cuts further out and reduce the cumulative magnitude. Powell clearly pushed back against rate cuts starting in March, and today’s report closes the door further. We stay with the forecast of a first cut in June and 125bps of easing in total this year.

Chart 1. Headline payrolls beat expectations and showed reacceleration after annual revisions

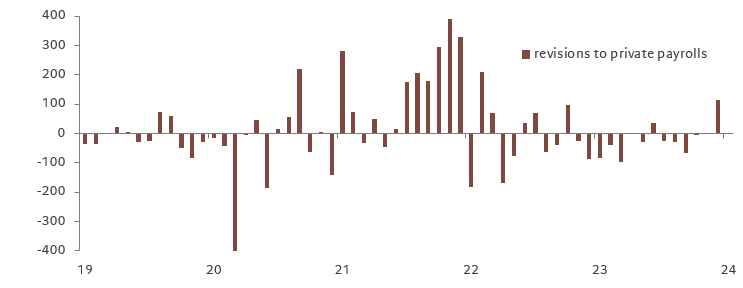

Chart 2. Revisions to private payrolls turned positive

Chart 3. Wage growth accelerated and remains inconsistent with the Fed’s 2% target

Chart 4. Hours worked fell to pandemic lows

Chart 5. Unemployment rate stayed unchanged as labor supply fell sharply

Chart 6. Labor income growth was modest, dragged down by the drop in hours

Chart 7. Employment by industry