By Frederik Ducrozet, Head of Macroeconomic Research, Pictet Wealth Management, ahead of the ECB meeting next Thursday (14 September).

The outcome of the 14 September meeting of the ECB’s Governing Council (GC) looks very uncertain, more than any ECB meeting in recent history. The last time the ECB surprised markets was in July 2022 with a 50bp rate hike, but at least everyone expected the ECB to hike then. Next week, the consensus of economists is split on the decision and markets are pricing in roughly 40% chance of a hike.

Now we shouldn’t exaggerate the importance of this decision either, beyond the excitement of a few ECB watchers who arguably get easily excited about things like TLTRO terms or the remuneration of excess reserves. Whether the ECB stops at 3.75% or 4% doesn’t really matter in the broader scheme of things. But markets will read the decision as the result of a tricky trade-off in terms of policy, communication and political forces within the GC.

We didn’t forecast the ECB to hike rates in September initially, but we changed our call before the summer to account for sticky core inflation and hawkish guidance, noting that “a September hike is not a done deal, and certainly a closer call than most observers believe”. Now that market pricing has shifted again in favour of a pause, we would argue that the likelihood of a hike is underestimated. Recent official comments have been leaning towards a pause, but we still expect a 25bp rate hike in September.

First, since the beginning of this tightening cycle, the ECB has argued that the risk of doing too little was higher than the risk of doing too much. One concern has been that the ECB’s credibility would be at risk if a pause proved premature. This should remain a guiding principle going into the September meeting.

Second, on a more tactical note, it is a case of ‘now or never’ for the ECB to hike. If the GC wants to keep a hawkish bias, then we believe a hike is a more credible option than a ‘skip’. The case of the Fed is different: policy rates are higher, monetary policy lags may be longer, and the FOMC can skip meetings while threating to hike later if the inflation outlook doesn’t improve. In the case of the ECB, it may look like a good compromise on paper but a ‘hawkish skip’ may not work in practice.

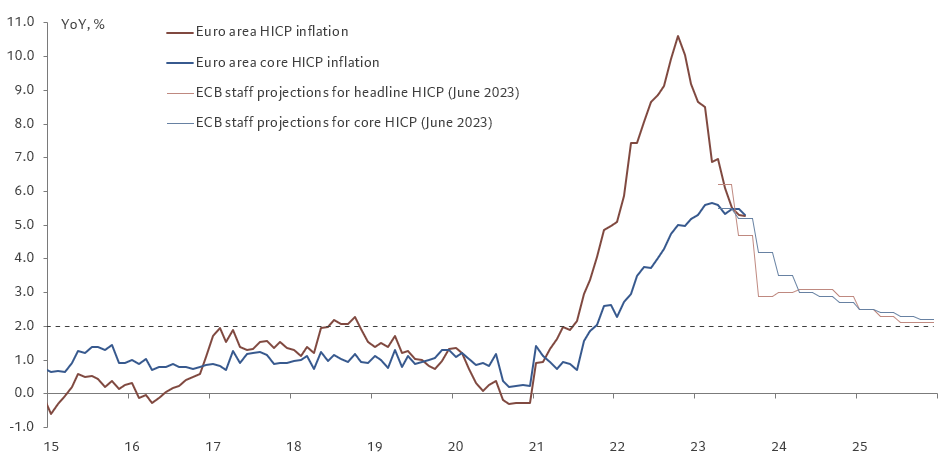

Indeed if the GC doesn’t hike in September, the case for additional tightening will likely weaken further in coming months. Core HICP inflation remains way above target at 5.3% in August but the underlying momentum has eased in recent months and the base effect will be strongly negative in September. The question is not if core inflation will decline in coming months, but by how much? We forecast core inflation to drop sharply, by about 100bp within two months, although seasonality factors have been all over the place since the pandemic and there is still uncertainty in terms of pricing behaviour in the services sector.

Meanwhile growth is likely to remain subdued as activity normalises in the services sector and credit demand weakened substantially. Nominal wage growth and unit labour costs have started to ease on a sequential basis, albeit from elevated levels. There is abundant evidence that policy transmission is working, but the question is whether the amount of tightening that is going to feed through the real economy will be enough to get inflation back to 2%. As noted in the accounts of the July meeting, “a further rate hike in September would be necessary if there was no convincing evidence that the effect of the cumulative tightening was strong enough to bring underlying inflation down in a manner consistent with a timely return of headline inflation to the 2% target”.

If the ECB doesn’t hike in September, what could make them hike again in October or beyond? A further spike in energy prices might be a factor along with a weaker currency, which may lead to a reacceleration in headline inflation and fuel concerns of another wave of second-round effects. In particular, the hawks may worry about the early signs of rising inflation expectations in the latest ECB’s Consumer Expectations Survey. Still, having focused on underlying inflation dynamics for months, it would feel odd for the ECB to tighten on a stronger headline if core keeps easing.

Regardless of the September decision, we expect the staff projections to be revised only marginally lower. Crucially, inflation is likely to remain slightly above target throughout the forecast horizon, justifying a hawkish bias. The recent weakness in leading indicators such as the PMIs may not be fully factored in, if only for technical reasons, although chief economist Philip Lane suggested that the staff may be adjusting their projections accordingly. Either way, a weaker growth profile would imply a wider output gap amid growing concerns over weaker supply. In turn, this may be consistent with a small downward revision to the 2025 median point for inflation, from 2.2% to 2.1% for headline HICP and from 2.3% to 2.2% for core.

The good news remains that policy transmission seems to be working, so that the ECB doesn’t need to overtighten to bring inflation back to target.

There was always going to be a price to pay on activity. The smaller the pain, the better.

To be sure, the ECB will not declare victory with inflation projected to remain above target. We expect the tone of the statement and the press conference to remain hawkish.

But after September, we feel increasingly confident that the ECB’s job will essentially be done.