Why we see value in technology?

Richard Clarke-Jervoise, Managing partner – ODDO BHF Private Equity, Venture Capital.

“Given the improvement in the investment environment, we believe that now is a good time for investors with long-term capital available to build portfolios of fast-growing, disruptive companies at very favourable terms.”

2023 was a good year for listed technology companies. The Nasdaq index gained +44%* and the enthusiasm for the largest tech stocks such as Nvidia was so great that analysts coined a new name for these companies … The Magnificent Seven – no, not a Clint Eastwood movie … yet!

2023 was also the year that Artificial Intelligence hit centre stage. The best example of this was OpenAI which broke all records to become the fastest company in history to reach 100 million users and $1bn in revenues. AI is expected to revolutionize the way enterprises across all sectors and industries operate, deliver significant gains in productivity. There were many other examples of the acceleration in technology adoption including the very rapid growth in wireless internet subscribers for Elon Musk’s Starlink and the jump in growth and profitability at large FinTechs such as Revolut and NuBank which is expected to announce its first net profit of $1bn.

All of this supports our strong conviction in both public and private technology companies. In particular, we believe that the conditions exist to see the creation of a new generation of $1tn companies which will challenge many of the companies created 20-30 years ago.

Despite this, many of the headlines were doom & gloom. These included the collapse of Silicon Valley Bank, the bankruptcy of WeWork and the continued fall in the amount of capital invested in start-ups. In reality, these are all part of a multi-year reset in the investment environment for private technology companies. This reset follows a period of oversupply of capital that began with the onset of covid and which distorted not only the number of companies funded, but also valuations, capital efficiency and founder mentality. The trend is therefore a natural and healthy market correction as we have seen in many other markets as interest rates have risen, reducing investor appetite for riskier assets.

Positive outlook for 2024 – liquidity is the name of the game

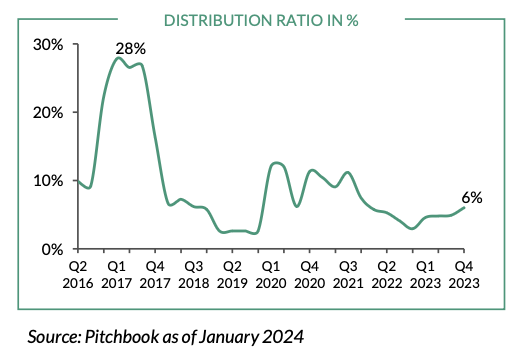

For investors with long-term capital available to commit to unlisted technology, the outlook is positive. Not only has technology adoption continued and in some cases accelerated, but the environment for new investments has improved significantly. Following the covid era exuberance and the rise in interest rates, the ensuing reset has seen a return to normality with lower valuations, improved investment terms and a focus on capital efficiency and profitable growth. More importantly, natural selection once again applies and only the best companies can raise capital. In addition to this more positive environment, we believe there is an opportunity which has been overlooked by most investors: this is the opportunity to acquire stakes in start-ups and in technology funds in the secondary market. Indeed, the one indicator for private technology companies which has not yet stabilized is the liquidity received by investors resulting from the sale or “exit” of those companies. This is a result of the prolonged closure of the IPO market and subdued mergers and acquisitions. This has caused the distributions received by technology investors to remain at historic lows.

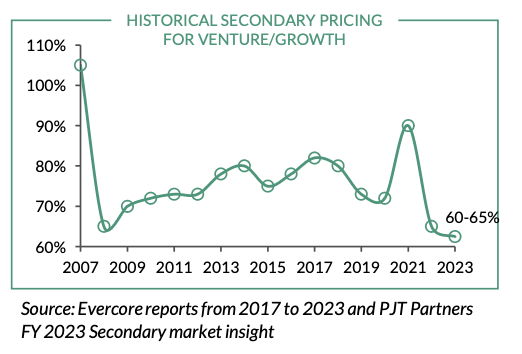

As a result, investors have turned to alternative sources to generate liquidity. The most readily available source has been the secondary market where a limited number of active secondary buyers provide liquidity solutions to investors. Given the imbalance between available capital and the growing demand for liquidity from investors, the pricing for technology secondaries has been very favourable with discounts reaching 30-50%.

Other reasons for these discounts have been the uncertainty over the pricing for such companies as well as the concerns of a liquidity squeeze. These factors have enabled secondary buyers to acquire direct or indirect stakes in some of the world’s leading technology companies for a fraction of their current valuation, offering the perspective of strong returns and relatively short holding periods.

ODDO BHF’s private assets team has an advantage in the field of technology secondaries given its strong secondary market expertise as well as its strong network in the technology ecosystem. This has allowed us to take advantage of the favourable market conditions to acquire stakes in some of what we believe are the most attractive technology companies at average discounts of close to 50%. Many of these companies are very strongly capitalized and are not expected to raise money again before going public or being acquired.

In conclusion, we believe that technology will continue to drive innovation and change at increasing scale and that recent technologies such as artificial intelligence, quantum computing and other technologies will lead to a new generation of technology giants. Given the improvement in the investment environment, we believe that now is a good time for investors with long- term capital available to build portfolios of fast- growing, disruptive companies at very favourable terms.