Securing single-digit annual returns from a diversified portfolio could prove an unusually complex task in the next five years, largely because of volatile inflation and more muscular state intervention.

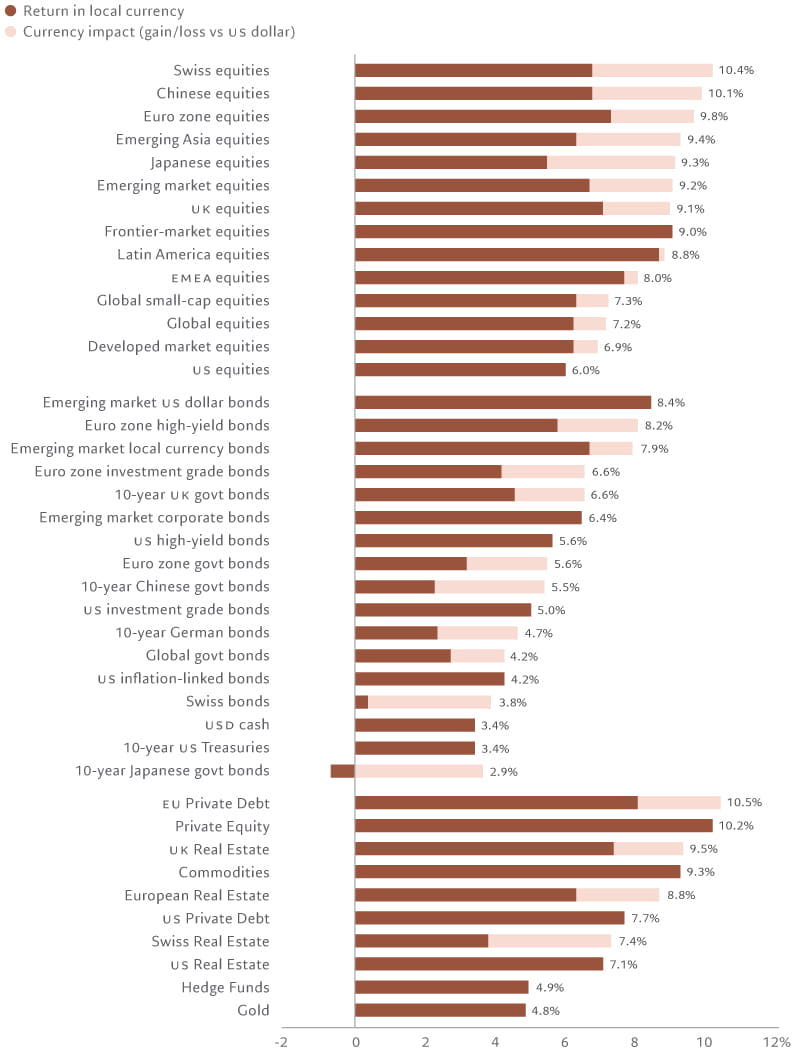

1. Overview: return projections for the next five years

Investment strategies will need an overhaul over the next five years. And for several reasons. Economic growth for the rest of this decade will remain stubbornly below average as inflation – while in retreat – is likely to be unusually volatile. Greater state intervention in the economy, meanwhile – in industries such as cleantech, semiconductors and defence – will not only add to the public debt burden but could also increase the risk of policy mistakes and capital misallocation.

The headwinds become more powerful still when the effects of weak productivity, labour shortages and tighter financial conditions begin to manifest themselves with greater intensity. Yet for nimble investors, and those prepared to venture beyond the beaten track of developed equity markets, several potentially rewarding opportunities remain.

Figure 1 – Asset class returns, 5-year forecast, %, annualised

Source: Pictet Asset Management, forecast period 30.04.2023-30.04.2028